Yes!

Of course, this yes comes with many caveats. But, really, it is much like the answer to Can I patent software? The answer is “Yes” you can patent software inventions. New, novel, and nonobvious business methods are, by law, patent eligible under 35 USC 101.

As it turns out, which I’ll get to later, NFTs can ALSO be used to help enforce patent rights themselves. Meaning, the ownership of and digital/real world rights associated (ability to prevent others from making, using, or selling) can have increased visibility and enforceability by attaching/associating patent rights to NFTs!

NFT means non-fungible token. I don’t know about you, but when I hear this, my mind goes to mushrooms (like the fungus) and arcade tokens. Anyone else

Ok, maybe I’m alone on the whole fungus and game token thing – anyway – I might come back to this later.

As an aside (yes I know, we haven’t gotten to the substance yet), you CAN patent new varieties of mushrooms, see Plant Patent article. And, yes – you can patent new and useful gaming machines that use tokenized monetization formats, see US 10,960,293 issued in March, 2021.

There has been much written about these NFTs and how the concept is quite useful, and might provide a very solid pathway to help clarify, authenticate, and make more concrete the ownership of many things that are otherwise uncertain.

Some of the really nice articles I found as foundational in helping me understand NFTs as a whole and for use in examples that follow related to patents were as follows:

- Forbes: https://www.forbes.com/advisor/investing/nft-non-fungible-token/

- The Verge: https://www.theverge.com/22310188/nft-explainer-what-is-blockchain-crypto-art-faq

- NY Times: https://www.nytimes.com/2021/03/11/arts/design/what-is-an-nft.html

- Tech Republic: https://www.techrepublic.com/article/nfts-cheat-sheet-everything-you-need-to-know-about-non-fungible-tokens/

- Coinbase: https://www.coinbase.com/learn/crypto-basics/what-are-nfts?

Some of the major highlights from these articles that pertains to us in the patent world are:

- NFTs allow for easy, blockchain-backed cryptocurrency transactions for tangible and intangible goods and services

- NFTs allow for a cognizable, verified ownership title/interest in these goods/services

- The ownership of tokens allows for certainty as to ownership and more accurate valuations with title/ownership questions reduced/eliminated

- The owner of an NFT only owns the token itself, and while it is undisputed ownership, it is separate from the ownership of any underlying intellectual property that may be associated with it

I do like coinbase’s definition best:

NFTs (or “non-fungible tokens”) are a special kind of cryptoasset in which each token is unique — as opposed to “fungible” assets like Bitcoin and dollar bills, which are all worth exactly the same amount. Because every NFT is unique, they can be used to authenticate ownership of digital assets like artworks, recordings, and virtual real estate or pets.

I do not claim to know anywhere near as much as some of these authors and technology experts do about NFTs. So, if you’re looking to learn more about what NFTs are and how they work…stop here and read elsewhere 😛

I’m going to attempt to discuss how NFTs are patent eligible and discuss the types of business methods that may be protectable under todays patent laws

So, if you read some of these articles, or have a decent understanding of NFTs, what you own, if you actually purchase one, is not the item or the code, or the digital file, or really anything that resembles what the token represents…it is, JUST the token itself.

To this end, a token does represent and is forever attached/associated with a certain article. What’s interesting is the way each token is attached or the system by which tokens can be bought, sold, traded, managed, analyzed – it’s those methods, those systems that are eligible for patent protection.

Example US 10,721,069: “Methods and systems for enhancing privacy and efficiency on distributed ledger-based networks”

The below is claim #1 from the above patent. While this gets very detailed quickly, the high-level innovation here is the concept of a combined non-fungible token and the method by which multiple non-fungible tokens can be transacted to form a unique tertiary non-fungible token.

- A method, comprising:

receiving a request that is configured to cause a transfer of a combined asset from a sender to a recipient, the combined asset including a first asset and a second asset, the first asset and the second asset represented on a distributed ledger-based network (DLN) by a first token commitment and a second token commitment, respectively;

generating, upon receiving the request, a combined non-fungible token identifying the combined asset, the combined non-fungible token including a combination of:1) a first non-fungible token identifying the first asset and obtained via an application of a first hashing function on a first identifying parameter of the first asset, and

2) a second non-fungible token identifying the second asset and obtained via an application of a second hashing function on a second identifying parameter of the second asset, the combined non-fungible token obtained via an application of a concatenation operator on the first non-fungible token and the second non-fungible token;providing, by a provider and to a self-executing code segment on the DLN, a zero-knowledge proof (ZKP) that the provider has knowledge of an identity of:

(1) the first non-fungible token, the first token commitment obtained via an application of a third hashing function on the first non-fungible token;

(2) the second non-fungible token, the second token commitment obtained via an application of a fourth hashing function on the second non-fungible token; and/or

(3) the combined non-fungible token, a third token commitment representing the combined asset on the DLN obtained via an application of a fifth hashing function on the combined non-fungible token; andreceiving, upon verification of the ZKP by the self-executing code segment, a confirmation confirming an addition of the third token commitment onto a commitments data structure of the DLN without an identifying information of the first asset, the second asset, the combined asset, the first identifying parameter of the first asset and the second identifying parameter of the second asset being revealed.

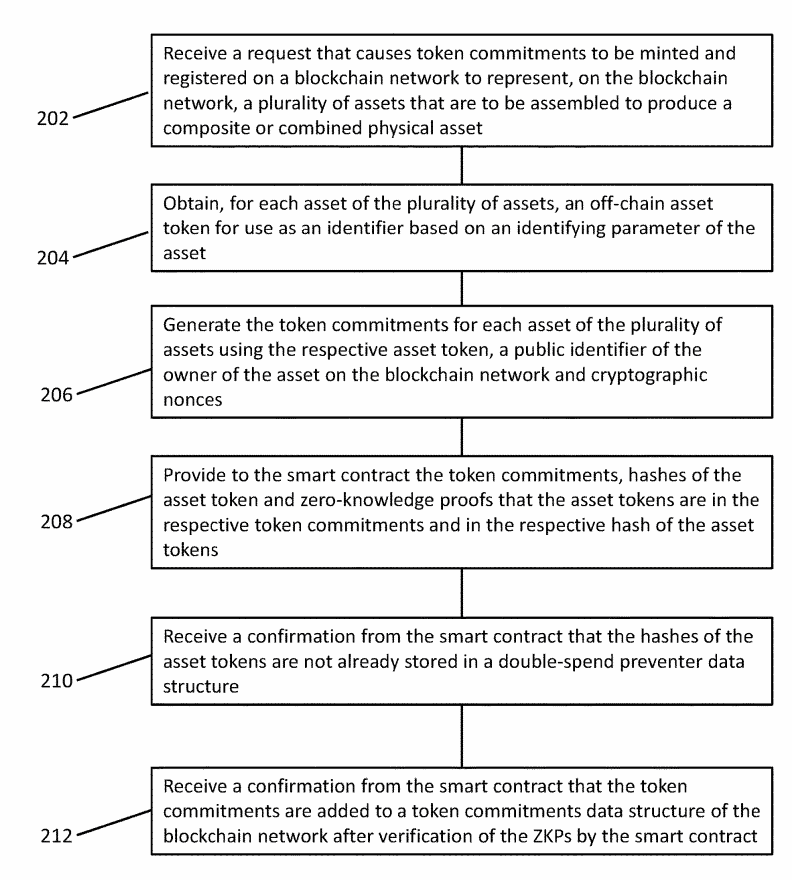

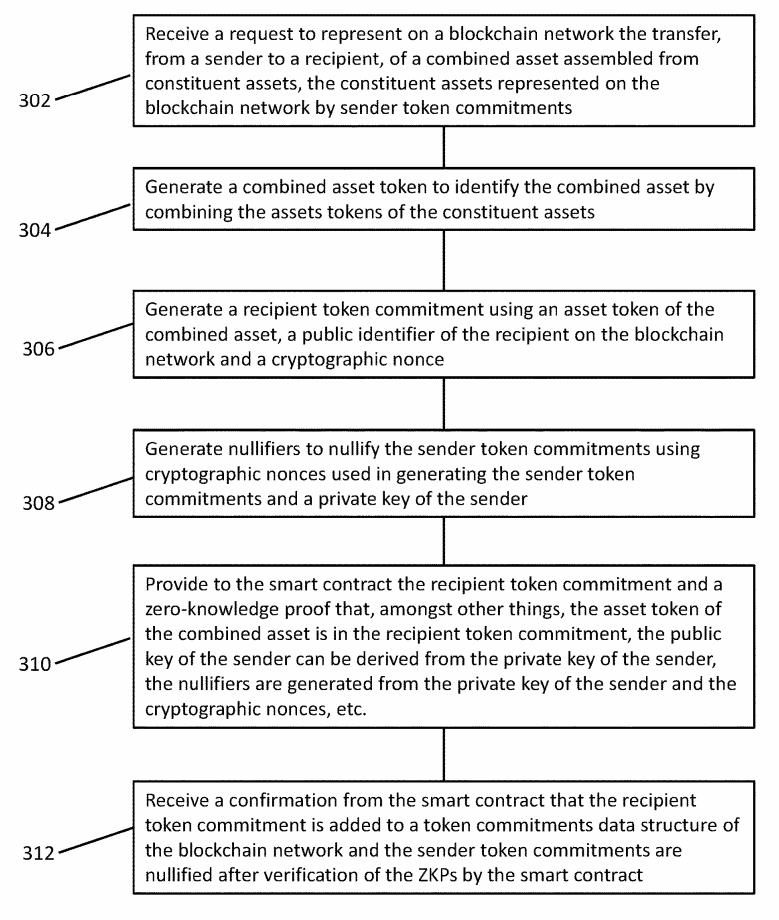

Now, for the layperson reading this – it could be a bit overwhelming. Usually, for most inventions that are methods or processes (which is most computer implemented technology), flowcharts are also included.

See Fig. 2 and 3 to see each step of the process which is also claimed above (in words)

And, it continues to the next page…

So, much like computer-implemented inventions that have unique code (which isn’t patented), the tokens themselves are unique in what they represent (which isn’t patented)…its the process, or the system/method by which the computer interacts with the user, or in this case for NFTs, how the distributed ledger network interacts with a user or “requests” in this claim.

Have a new way to transact using NFTs?

Think of a way to make NFT transactions safer or more private?

Have you discovered a way to analyze inputs and outputs of NFT transactions that yields a unique utility?

It’s very likely that you’ve invented a new method and if you think there’s a chance that you could monetize, implement, and commercially exploit it, you should secure it with patent protection!

Bold Patents’ Patent Attorneys stand ready to help you with researching to confirm novelty, and then to help you draft a patent application to get your rights granted.

Schedule your free Discovery Call today at this link: https://boldip.com/contact/

Go Big, Go Bold!℠